Home Equity Loan Advantages: Why It's a Smart Financial Move

Home Equity Loan Advantages: Why It's a Smart Financial Move

Blog Article

The Leading Reasons That Homeowners Pick to Safeguard an Equity Funding

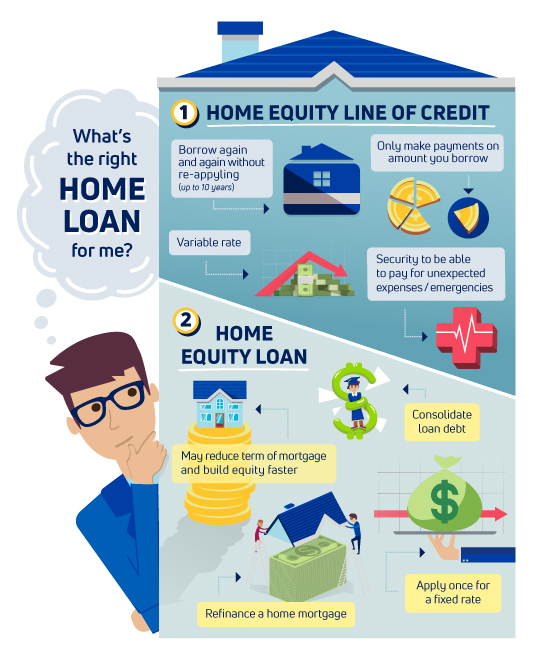

For numerous property owners, selecting to protect an equity funding is a strategic monetary decision that can provide various advantages. The ability to use the equity constructed in one's home can offer a lifeline during times of monetary demand or work as a device to attain certain goals. From consolidating debt to undertaking major home improvements, the reasons driving people to go with an equity loan are varied and impactful. Comprehending these motivations can lose light on the sensible economic preparation that underpins such selections.

Financial Debt Debt Consolidation

Property owners usually decide for protecting an equity financing as a tactical economic action for debt loan consolidation. By leveraging the equity in their homes, individuals can access a lump sum of money at a reduced rate of interest compared to various other types of borrowing. This resources can then be used to pay off high-interest financial debts, such as bank card balances or individual loans, enabling home owners to simplify their economic obligations right into a single, much more convenient month-to-month settlement.

Debt debt consolidation through an equity finance can provide numerous benefits to homeowners. The lower interest price connected with equity finances can result in significant price savings over time.

Home Improvement Projects

Thinking about the boosted worth and capability that can be attained through leveraging equity, numerous individuals opt to allot funds towards various home enhancement tasks - Alpine Credits Home Equity Loans. Property owners typically pick to protect an equity lending specifically for renovating their homes as a result of the significant rois that such tasks can bring. Whether it's updating out-of-date functions, increasing space, or improving energy performance, home enhancements can not just make living areas a lot more comfy but additionally boost the general value of the building

Typical home renovation projects moneyed through equity car loans include cooking area remodels, restroom restorations, cellar finishing, and landscape design upgrades. By leveraging equity for home renovation projects, house owners can produce areas that far better match their demands and choices while also making a sound economic investment in their property.

Emergency Situation Expenses

In unanticipated circumstances where prompt monetary support is needed, protecting an equity loan can offer homeowners with a sensible service for covering emergency costs. When unforeseen events such as medical emergencies, urgent home repair services, or abrupt task loss occur, having accessibility to funds with an equity lending can use a safeguard for homeowners. Unlike other kinds of borrowing, equity lendings generally have lower rates of interest and longer settlement terms, making them a cost-effective choice for dealing with instant economic needs.

One of the crucial benefits of utilizing an equity finance for emergency expenditures is the speed at which funds can be accessed - Alpine Credits Home Equity Loans. Property owners can quickly use the equity constructed up in their building, permitting them to address pressing economic problems without hold-up. Furthermore, the versatility of equity car loans makes it possible for home owners to borrow only what they need, avoiding the concern of handling excessive financial obligation

Education And Learning Funding

Amidst the pursuit of greater education, protecting an equity finance can act as a calculated funds for property owners. Education financing is look these up a substantial issue for many households, and leveraging the equity in their homes can give a method to gain access to needed funds. Equity loans typically use reduced rate of interest compared to various other kinds of financing, making them an eye-catching choice for financing education costs.

By using the equity accumulated in their homes, homeowners can access significant quantities of cash to cover tuition charges, books, accommodation, and various other related costs. Equity Loan. This can be particularly helpful for parents wanting to support their kids via university or people seeking to enhance their own education. Additionally, the rate of interest paid on equity financings may be tax-deductible, giving prospective financial benefits for borrowers

Inevitably, utilizing an equity finance for education and learning funding can help individuals buy their future earning potential and job advancement while efficiently managing their financial obligations.

Investment Opportunities

Verdict

In final thought, home owners choose to protect an equity finance for different reasons such as financial obligation loan consolidation, home improvement jobs, emergency situation costs, education funding, and investment opportunities. These fundings supply a method for property owners to gain access to funds for vital financial demands and objectives. By leveraging the equity in their homes, homeowners can take benefit of reduced rates of interest and adaptable settlement terms to achieve their financial objectives.

:max_bytes(150000):strip_icc()/home_equity.asp-final-59af37ca6ebe48f3a1e0fd6e4baf27e4.png)

Report this page